Are you the Primary or Secondary Investor and Why It Matters

Are you the Primary or Secondary Investor

and Why It Matters

What many Australians entering into the property market may not realise is the significant difference in targeted returns when it comes to investing at different points in the property development process. We identify the differences between participation in early or late stage investments, acting as either a primary or a secondary investor. Focusing on this simple concept can greatly improve investment performance and how quickly you reach your financial objectives.

Are you a Primary or Secondary Investor?

An example of a primary investor is an investor that buys a block of raw land then aims to add value through subdivision into multiple blocks. The secondary investor on the other hand, is likely to be the purchaser of one of these subdivided blocks with little or no room to add value except through future, organic capital growth. This is the traditional off-the-plan purchase that most Australian mum and dad investors have grown to be familiar with.

However, if an investor can take the mindset of a primary investor, it allows them to look different at the properties they currently own, and the types of property they may consider for investment in the future.

“The challenges is two parts… access to the same opportunities as the primary investor … and mitigating risk”

The challenge is two parts for families. The first is to gain access to the same opportunities as the primary investor. And the second when achieving the primary investor point is mitigating risk and their potential life savings. No one wants to lose their shirt.

Quantifying the difference

To give you an idea of the difference in potential returns of a primary and secondary investor, let’s look at two different ways of investing $200,000.

A secondary investor purchasing a property valued at $200,000 relies on the future returns on the $200,000 value of the property, with a national 25 year average hovering around 6.8% growth annually.

However as a primary investor, you could be looking at immediate returns on your assets of 15% (conservatively) to over 25% (what many experts achieve), through methods such as subdivision into multiple smaller lots, or re-zoning of the property. Increasing your asset value by 20%, for example, you would see an immediate $40,000 increase in cash if you sold your property or in equity if you keep your property. Either way you’re way ahead in the property investment game at a potentially faster rate, while also benefiting from the future capital growth on a more valuable asset if you keep it.

If we keep our investment and look at it within a conservative 5 year scenario, the difference in your pocket could add up even more to over $55,000. Assuming 6.8% growth rates over a 5 year period. The secondary investor’s $200,000 asset may “only” increase to $277,899. In contrast the primary investor’s $240,000 asset (with 20% initial margin) may now have increased in value to $333,478. This disparity in returns will only continue to grow the longer the investments are held, highlighting the rewards of taking the primary investor mindset.

How does the average Australian go from secondary to primary investor

So how does the average Australian go from being a secondary to a primary investor in the property market? The first is probably looking in their own backyard, literally! Perhaps your own home or earlier investment may have the potential to be subdivided, allowing you to extract extra value without even having to look elsewhere!

For most however, learning the ins and outs of property development can be a steep learning curve and this is where investors may start to work with established developers and property investment experts in the field. If you go down the second route, you should ensure that you pick the right people – ensuring they have the expertise and experience to see the project through and a track record of successful projects.

For more on winning projects and mitigating risks see more of Michael Blogs Property

Michael Mamasis

Own Your Own Block (OYOB)

Property investment strategies and property advice.

*Information resourced from: Investormastermind; Stephen Chandler, EFTA and Property Development Institute; Rate City and CoreLogic.

500 Kilometre Hill

500 Kilometre Hill

Just when you think you can’t- keep your eyes on the road

This year I became very intimate with one of our charities Hands Across the Water, and was reminded of some of the steps of overcoming challenges on a very personal level. As part of our fundraising efforts, a team of 15 including OYOB business partners and clients, flew to Thailand for our annual bike ride. Each one of us committing over 500 kilometres of riding to help raise funds. We also had the privilege of meeting the community and at-risk children with Aids that we have been supporting over the last few years.

The experience of staying with the children and seeing firsthand the impact that external funding has on helping them live normal, healthy lives was something that went deeper then just facing a hill. However, the interpersonal challenges we all face are integral to giving back in a more profound and impactful way. And this part of my own journey reflects this very personal challenge. I was reaching deep outside of my own comfort zones and surrendering to a multitude of fears that found myself persevering. At the end of the journey, I came to realise how strong I really was.

“My own brother thought I couldn’t do more than 20k’s”

Connecting to the charity and their needs with such heart, and then coming back to the privileges of Australia was an incredibly humbling experience that has provided profound and overwhelming purpose and drive for my life and my work (which I’ll post about later!)… But for now, let’s get the hill out of the way, a hill that became my mountain.

My own brother thought I couldn’t do more than 20k’s. And well, personally, I had never ridden more than 15k’s in my life. Before the ride and early on during the first 100k’s, I was already strapped with a number of fears. A massive fear of falling from a bike obviously designed for a 6 footer, on top of pounding and unbearable heat. My body was stiff and sore from stress. And though I had prepped physically. Mentally I had already told myself I could just go on the bus. I was setting myself up for a way out, and safeguarding my ego and my fears of failure.

“We often impose limitations on ourselves, we let other people impose limitations, but it’s not until we test those limitations that we really find what are true potential is”

But amazingly I kept pace, and my team was more than supportive – they were my lifeline. I surprised myself at every turn, all until day 4.

And then, despite all the challenges I had overcome. All the personal physical and mental “go Mary’s” I had worked through, prepped for, and faced. The heat I had conquered. My balance and belief that I could actually ride a bike that far. Coping with pain, stiffness and aches. I was at my limit, the body began to fight back- my neck and shoulders at the point of agony.

And that’s when I saw this massive hill. My initial thoughts where, there was no way I was going to do it. I was ready for the bus.

The team said, “What goes up must come down” “There’s always a downhill”. “It’s not that big of a hill”. There words encouraging, my team supportive, trying to shrink the problem before me.

So I started. Up, and up.

However, I realised very shortly I couldn’t look up, if I looked up I would ruin myself. It would be too daunting and I would never finish. So I looked down, firmly on the road and I just peddled. One little piece of dusty, rocky mix of tarmac and bush trail at a time. Just like the little engine that could. I was the little Mary that did! It was amazing. I had ridden so much of this vertical leviathan. I was gobsmacked at my will and fortitude.

To my relief a small little outcry of a resting spot presented itself, so a few of us took it. However, it was in this rest, which the flood of truth came in. There was more, and more hill to go, and it still seemed endless. The physical pain instantly engulfed my body- and it all came crashing down.

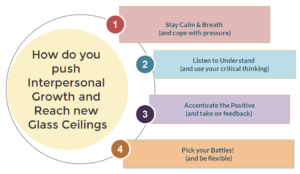

I wish I could say that I finished that day. But I didn’t. I finished my total 500+ k’s and I am proud of myself. But this moment of surrender had such an impact on me. And it went back to what Peter Baines told me after my first 100k’s. “We often impose limitations on ourselves, we let other people impose limitations, but it’s not until we test those limitations that we really find what are true potential is”. I learned at camp later that day that there was only 12 more kilometres of hill to go. I could have done it! But I surrendered to my own limitations. Thankfully to the inspiration of giving back to our charity, my team, and my own personal journey- those limitations have happily found a new glass ceiling.

Mary Ignatidis

Proud to have helped raise over $50,000 for Hands Across the Water, riding over 500 kilometres in 5 days and helping the 76 children that reside in Home Hug!

One of my own personal goals is to introduce as many people as possible to Hands Across the Water and support their mission to enrich the lives of disadvantaged children and communities in Thailand. Please say hi, follow, like or comment and I’ll make sure I keep you updated with our plans and how we can all get involved.

#Generosity Economy- Goodwill and Good Giving

#OYOB- Property, People, Passion

See me after my first 100K with Peter Baines: DGR Bike Ride for Hands Across the Water!!!!